All Weather Strategy

A self-custodial digital asset strategy inspired by long-cycle diversification principles.

- Rules-Based Allocation

- Thematic Diversification

- High-Touch Client Support

A self-custodial digital asset strategy inspired by long-cycle diversification principles.

Strategic allocation logic monitors market liquidity and sector weighting.

Designed to reflect distinct growth verticals across crypto markets.

Personalised onboarding and education to support confident self-directed engagement.

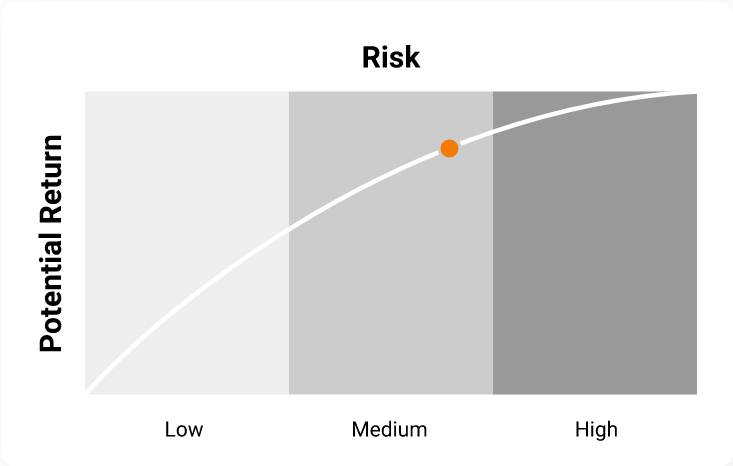

The All Weather strategy is designed for qualified individuals seeking a diversified digital asset approach while maintaining full self-custody. It is particularly suitable for those with a long-term view on Bitcoin and the broader blockchain economy.

| Name | Name | Name | Name | Name |

|---|---|---|---|---|

| 1Inch (1INCH) | Aave (AAVE) | Bitcoin (BTC) | Chainlink (LINK) | Curve DAO (CURVE) |

| Decentraland (MANA) | Ethereum (ETH) | Filecoin (FILE) | Polygon (POL) | SushiSwap (SUSHI) |

| Synthetix (SNX) | The Graph (GRT) | The Sandbox (SAND) | Uniswap (UNI) | - |

This structure is not designed to defend against all market volatility. It is instead engineered to capitalise on sustained upside in crypto markets — particularly if Bitcoin resumes a strong multi-year trend post-halving.

Its passive design minimises the need for reallocation, even during short-term volatility. The strategy is intentionally constructed to let long-term conviction play out over time.

This strategy is hypothetical and presented for educational purposes only. It does not constitute financial advice or an offer to invest. Participation is by private invitation only, and availability depends on your jurisdiction and eligibility. No guarantees are made regarding performance. Please consult a regulated professional before making financial decisions.

Important Notice: This site is for educational and informational purposes only. It does not provide investment advice, financial promotions, or custodial services. All services are non-regulated and only available to eligible individuals under applicable exemptions.

© 2025 Bridgegap Capital. All rights reserved.