Optimal Performance

This strategy is designed to pursue aggressive exposure across high-growth blockchain sectors.

- Tactical Asset Allocation

- Diversified Sector Focus

- High-Touch Client Service

This strategy is designed to pursue aggressive exposure across high-growth blockchain sectors.

Allocations are actively reviewed and rules-based, focusing on liquidity and thematic momentum.

Exposure spans multiple emerging blockchain verticals.

Educational walkthroughs and one-on-one guidance included.

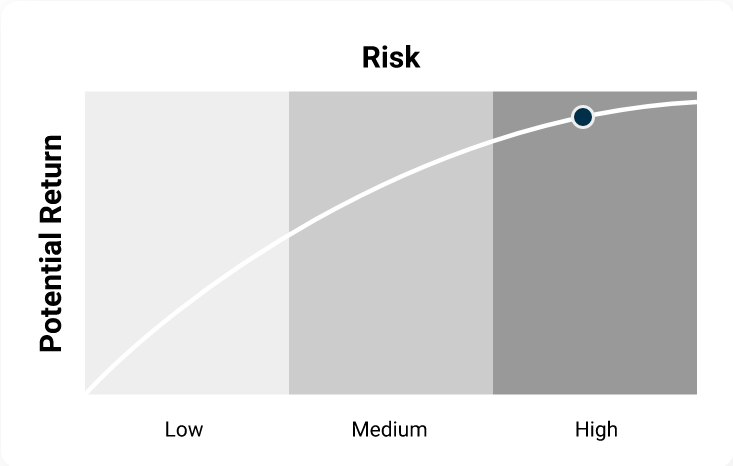

The Optimal Performance strategy is for experienced individuals seeking concentrated exposure to high-growth opportunities. It is most appropriate for those who maintain a strong long-term outlook on digital asset markets and are comfortable with higher volatility in exchange for greater potential upside.

| Name | Name | Name | Name |

|---|---|---|---|

| 1Inch (1INCH) | Bitcoin (BTC) | Chainlink (LINK) | Decentraland (MANA) |

| Ethereum (ETH) | Filecoin (FILE) | Polygon (POL) | SushiSwap (SUSHI) |

| Synthetix (SNX) | The Graph (GRT) | The Sandbox (SAND) | Uniswap (UNI) |

The Optimal Performance strategy is engineered to target asymmetric upside by allocating across high-growth blockchain sectors. It assumes a long-term continuation of the broader crypto adoption cycle, with a focus on relative strength and liquidity across digital assets.

This structure is not designed for passive market coverage, but rather to reflect a more concentrated, tactical thesis — while still maintaining self-custody and participant discretion at all times.

This strategy is hypothetical and presented for educational purposes only. It does not constitute financial advice or an offer to invest. Participation is by private invitation only, and availability depends on your jurisdiction and eligibility. No guarantees are made regarding performance. Please consult a regulated professional before making financial decisions.

Important Notice: This site is for educational and informational purposes only. It does not provide investment advice, financial promotions, or custodial services. All services are non-regulated and only available to eligible individuals under applicable exemptions.

© 2025 Bridgegap Capital. All rights reserved.