Prime Innovation

A high-conviction digital asset structure focused on breakthrough blockchain sectors and innovation themes.

- Focused Asset Allocation

- Innovation Sector Focus

- White-Glove Client Support

A high-conviction digital asset structure focused on breakthrough blockchain sectors and innovation themes.

A narrow, high-upside strategy focused on trend-leading tokens.

Sectors include data economy, decentralised exchanges, metaverse assets, and smart infrastructure.

Educational guidance and transparent walk-throughs included for qualified participants.

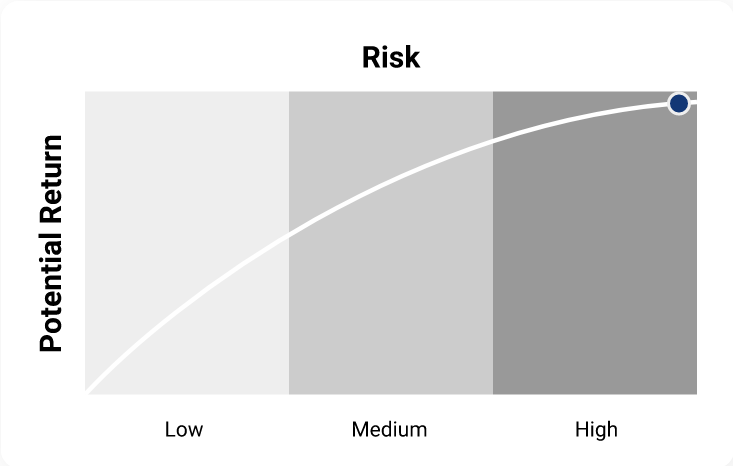

This strategy is intended for individuals with a long-term belief in blockchain innovation and a preference for focused, thematic exposure. It is best suited to participants who are comfortable with volatility and understand the asymmetric nature of early-stage opportunities.

| Name | Name | Name | Name |

|---|---|---|---|

| 1Inch (1INCH) | Decentraland (MANA) | Chainlink (LINK) | Polygon (POL) |

| SushiSwap (SUSHI) | Synthetix (SNX) | The Sandbox (SAND) | Uniswap (UNI) |

The Prime Innovation strategy is designed to capture structural upside from emerging blockchain sectors that exhibit early network effects and disruptive potential.

This model is intentionally focused — favouring high-conviction, early-stage exposure over broad diversification. Participants should be comfortable with volatility and longer holding horizons, as the strategy is aligned with high-growth, high-risk innovation cycles.

This strategy is hypothetical and presented for educational purposes only. It does not constitute financial advice or an offer to invest. Participation is by private invitation only, and availability depends on your jurisdiction and eligibility. No guarantees are made regarding performance. Please consult a regulated professional before making financial decisions.

Important Notice: This site is for educational and informational purposes only. It does not provide investment advice, financial promotions, or custodial services. All services are non-regulated and only available to eligible individuals under applicable exemptions.

© 2025 Bridgegap Capital. All rights reserved.